Managing diabetes means paying close attention to all aspects of your health; including your eyes. Diabetes can affect vision in several ways, so regular eye exams are often part of a comprehensive care plan. One of the most common questions people have is whether diabetic eye exams are covered by insurance.

The short answer is: most often, yes; but coverage can depend on a few key details. Understanding how your insurance handles diabetic eye care can help you stay on top of your vision needs without unexpected costs.

Why Diabetic Eye Exams Are Important

Diabetes can affect many areas of the body, and the eyes are no exception. Over time, high blood sugar levels can damage the tiny blood vessels in the retina, leading to a condition called diabetic retinopathy. Left unchecked, this condition can impact vision and increase the risk of serious complications.

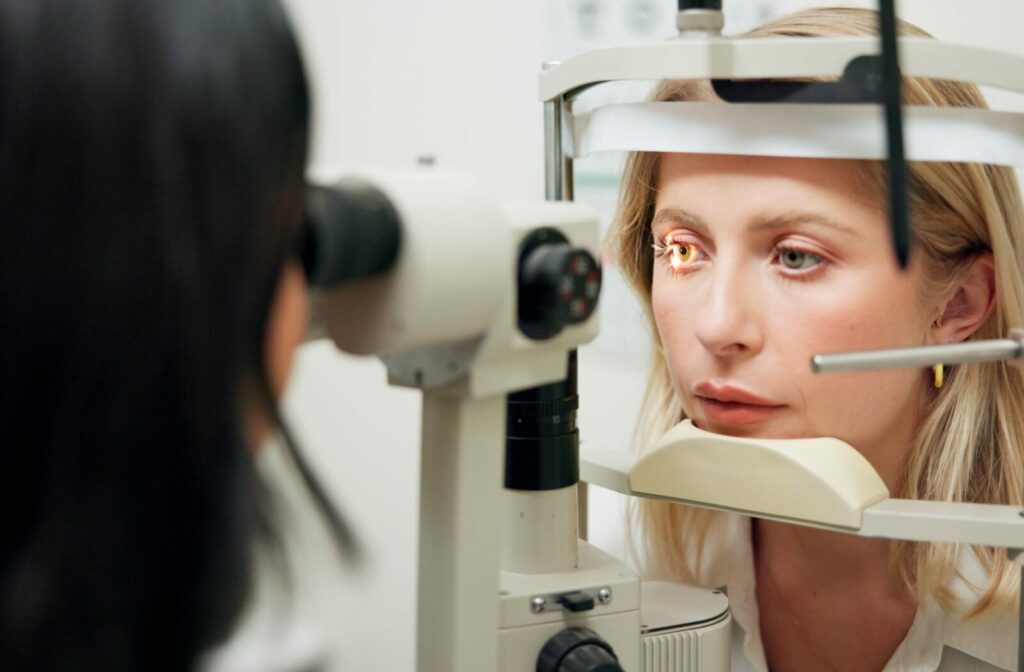

Regular diabetic eye exams give your optometrist the chance to monitor your eye health and catch changes early. These exams are typically more in-depth than a standard vision screening and may include tests designed specifically for patients with diabetes.

What Makes a Diabetic Eye Exam Different?

A diabetic eye exam is more than just a vision check. It includes a thorough evaluation of the internal structures of the eye, especially the retina and blood vessels.

During this type of exam, your optometrist may:

- Use dilating drops to widen your pupils for a better view of the back of your eye

- Take retinal photographs or other diagnostic images

- Look for early signs of damage caused by high blood sugar levels

- Review any vision changes or symptoms you’ve been experiencing

Because of the medical nature of this exam, it’s often billed differently than a routine vision exam.

Insurance Coverage for Diabetic Eye Exams

When it comes to insurance, the key question is whether the exam is classified as a medical or vision service. Diabetic eye exams typically fall under the category of medical care, which means they’re usually billed through your health insurance; not your vision plan.

This can work in your favor, especially if:

- You have a diagnosis of diabetes from a healthcare provider

- The exam is being done to monitor or manage a known condition

- Your eye doctor is submitting the claim using medical diagnosis codes

In many cases, health insurance plans can help cover the cost of diabetic eye exams when they’re medically necessary. However, coverage can vary depending on your personal plan and provider network.

What About Vision Insurance?

Vision insurance plans are often focused on preventive care and routine services, like:

- Basic eye exams to check visual acuity

- Prescription updates for glasses or contacts

- Discounts on eyewear

Because diabetic eye exams fall under medical care, they may not be fully covered by vision-only plans. It’s a good idea to double-check with your insurance provider or speak directly with your optometry office. They can help you understand how your plan works and what costs to expect.

How to Find Out What’s Covered

It’s normal to have questions about what your insurance will and won’t cover. Every plan is a little different, but here are a few tips that can help you get clear answers:

Ask your insurance provider:

- Does my plan cover diabetic eye exams under medical or vision benefits?

- Do I need a referral from my primary care provider?

- Are there any copays or deductibles I should be aware of?

- Is there a limit on how often I can get this type of exam?

Talk to your optometry office:

- Can you help me check my benefits before the exam?

- Will this exam be billed to medical insurance or vision insurance?

- Are you in-network with my plan?

Being proactive and asking questions ahead of time can help you feel more prepared and confident going into your appointment.

Why Timing Matters

Diabetic eye exams are typically recommended once a year, even if your vision seems stable. This regular schedule gives your optometrist the opportunity to catch subtle changes early, before they develop into bigger issues.

If you’ve recently been diagnosed with diabetes or changed insurance providers, it’s a good time to review your coverage and book your next exam.

Delaying this important care could mean missing the chance to catch warning signs of diabetic retinopathy or other complications early on.

A Personalized Approach to Eye Health

Navigating eye care with diabetes might seem overwhelming at first, but support is available. Many optometry offices are experienced in working with patients managing diabetes and can guide you through the process of scheduling and billing for a diabetic eye exam.

At Advanced Eyecare Optometry, your doctor is familiar with the details that go into providing diabetic eye exams and working with a variety of insurance plans. With a compassionate and knowledgeable approach, she’s happy to help you make sense of your coverage and get the care you need. If you’re due for your next diabetic eye exam, or have questions about what your plan covers, reach out today to get started.